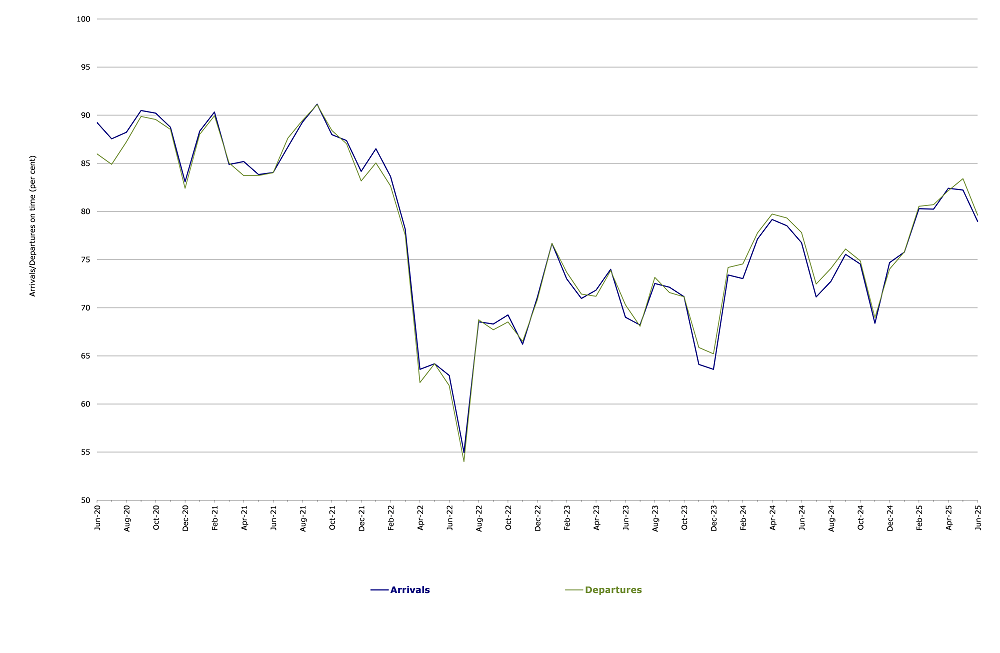

Airline On Time Performance, 2024-25 Financial Year

Summary – 2024-25 Financial Year

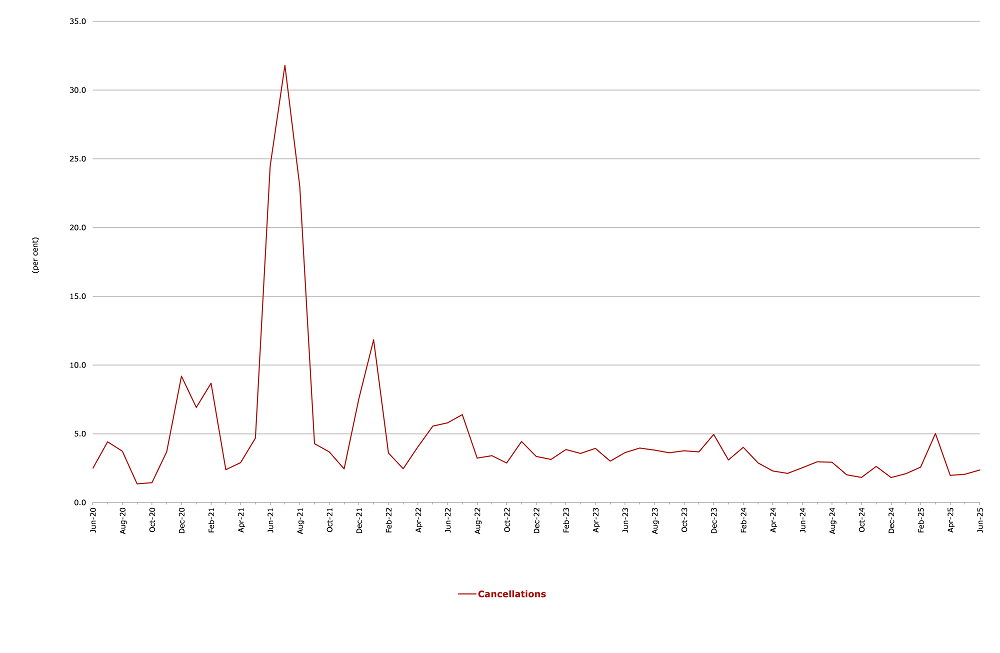

For the year ended June 2025, on time performance (OTP) over all routes operated by participating airlines (Hinterland, Jetstar, Qantas, QantasLink, Rex Airlines, SmartLynx Australia (formally Skytrans), Virgin Australia and Virgin Australia Regional Airlines) averaged 76.3% for on time arrivals and 76.8% for on time departures. The cancellation rate for the year was 2.5%. The equivalent figures for 2023-24 were 72.6% for on time arrivals, 73.3% for on time departures and 3.4% for cancellations. Airlines’ on time performance varies across the routes they serve. Individual route data by specific airline for 60 routes are shown on pages 9 21.

The 2024-25 on time arrivals figure was lower than the long-term average performance for all routes (80.7%) and the on time departures figure was also lower than the long-term average (81.8%). The rate of cancellations was higher than the long-term average of 2.2%.

The Qantas network (Qantas and QantasLink combined operations) recorded 76.6% for on time arrivals while the Virgin Australia network (Virgin Australia and Virgin Australia Regional Airlines combined operations) recorded 75.6%. Hinterland achieved the highest on time arrivals at 88.3%, SmartLynx Australia at 87.2%, QantasLink at 77.7%, Virgin Australia at 75.8%, Qantas at 75.0%, Jetstar at 74.8%, Rex Airlines at 74.0% and Virgin Australia Regional Airlines at 68.8%.

The Qantas network recorded 77.1% for on time departures while the Virgin Australia network recorded 76.5%. Hinterland achieved the highest level of on time departures for 2024-25 at 92.2%, followed by SmartLynx Australia at 87.3%, QantasLink at 77.9%, Rex Airlines at 77.1%, Virgin Australia at 76.8%, Qantas at 75.8%, Jetstar at 72.7% and and Virgin Australia Regional Airlines at 64.5%.

SmartLynx Australia recorded the highest percentage of cancellations (7.3%) during the year. The second highest cancellation rate was from QantasLink at 3.4%, followed by Qantas (2.9%), Rex Australia (2.6%), Jetstar (2.0%), Virgin Australia and Virgin Australia Regional Airlines (both 1.6%) and Hinterland (1.2%).

Of the 58 routes which met the criteria for on time performance reporting for all 12 months in 2024-25, the Emerald-Brisbane route had the highest percentage of on time arrivals (85.4%), while the Adelaide-Gold Coast route had the highest percentage of on time departures (86.1%). The Launceston-Brisbane route had the lowest percentage of on time arrivals (55.3%) and the lowest percentage of on time departures (55.7%).

Cancellations were highest on the Canberra-Sydney route at 5.7%, followed by the Sydney Canberra route at 5.1%, the Melbourne-Sydney at 4.7%, the Sydney-Melbourne route at 4.6%, the Emerald-Brisbane route at 4.3% and the Port Lincoln-Adelaide route at 3.8%.

Of the airports with OTP reporting for 2024-25, Newman Airport recorded the highest percentage of on time arrivals (82.8%), while Emerald Airport had the highest percentage of on time departures (84.7%). Rockhampton Airport recorded the lowest percentage of on time arrivals (68.5%) and Broome Airport recorded the lowest percentage of on time departures (57.9%). These figures only refer to reported routes and do not cover all flights at these airports.

| Reporting Airlines | Sectors Scheduled | Arrivals On Time % | Departures On Time % | Cancellations % |

|---|---|---|---|---|

| Hinterland | 16,363 | 88.3 | 92.2 | 1.2 |

| Jetstar | 92,974 | 74.8 | 72.7 | 2.0 |

| Qantas - all QF designated services | 230,592 | 76.6 | 77.1 | 3.2 |

| Rex Airlines | 54,429 | 74.0 | 77.1 | 2.6 |

| SmartLynx Australia (formally Skytrans) | 10,423 | 87.2 | 87.3 | 7.3 |

| Virgin Australia - all VA designated services | 144,305 | 75.6 | 76.5 | 1.6 |

| All Airlines | 549,086 | 76.3 | 76.8 | 2.5 |

| Individual operating entities | ||||

| Qantas | 91,258 | 75.0 | 75.8 | 2.9 |

| QantasLink | 139,334 | 77.7 | 77.9 | 3.4 |

| Virgin Australia | 141,014 | 75.8 | 76.8 | 1.6 |

| Virgin Australia Regional Airlines | 3,291 | 68.8 | 64.5 | 1.6 |